From: The Cryptonite Weekly Rap <cryptoniteventures@substack.com>

Date: Sun, Jan 5, 2025, 10:28 PM

Subject: Cryptonite's predictions for 2025—Short Google, Nvidia, & OpenAI?, the Elon/Zuck alliance, Robotaxis takeover, IPO…

To: <g@xny.io>

Our prognostications in 2025Today, Cryptonite presents our top 12 predictions for 2025 below. When you look at the results of our 2024 predictions, you are going to want to pay attention. While our prognostications are often controversial at first blush, we understand what our readers need to know to survive and prosper, and you can expect us to bat a thousand again in 2025!

The Day that Google Search DiedGoogle search is, of course, not dead. Google still dominates the search engine market, holding over 92% market share by processing approximately 99,000 queries every second. However, the first time our editors used Perplexity.ai, we never needed Google search again to get our work done. We conservatively guesstimate that Perplexity.ai saves us 70% of our editorial time and significantly improves the quality of our output. We have been so pleased with our new tool that we quickly started sharing our Perplexity.ai search queries with our readers. As you browse The Rap, you will see that over 90% of our links lead to Perplexity.ai PRO ($20 per month or $200 annually) search results (even if you do not pay for Pro service), which we think hugely enriches the body of our work, as it allows our readers to easily dig much deeper into the companies, trends, and subjects we regularly cover. It also better supports our often controversial opinions 😉 on the news.

In fact, we want to go on record as the first (and maybe only) editorial team that makes sharing these query links a regular practice for the benefit of our readers. If you don't believe us, check out this Perplexity query link which validates our status.😎🤙🏼 We are not so self-centered to believe this situation will remain constant. Global editors and readers will quickly catch up. In fact, industry analysts are already forecasting that Google's share of the US search market is projected to tank below 50% by 2025 😳 primarily due to the rise of generative AI search competitors. If Google is projected to go from 92% market share to 50% in the area that represents up to 90% of its revenue, is it time to short its stock? 🤔 Startups and Big Semis will chip away at NVDIA's market share.Nvidia was founded in April of 1993 by current CEO Jensen Huang, Chris Malachowsky, and Curtis Priem and staged its IPO 26 years ago on January 22, 1999, on the back of releasing the GeForce 256, marketed as the world's first GPU chip that powered the Xbox and later PlayStation 3. Historically, the company's stock price was essentially flat, but Nvidia powered forward and invested billions in AI technology, even when it was still a zero-billion dollar market.

Nvidia's early bet on AI dramatically paid off, and its stock started its way up in 2020 when the company announced its largest GPU, the A100 for AI and HPC (High-Performance Computing), and formerly became the AI chip leader. By 2023, Nvidia's market value surpassed $1 trillion, driven by the generative AI boom, and the company now dominates with an estimated 70% to 95% market share in AI chips. Today, Nvidia's (NVDA) market cap is $3.5 trillion, with a forward P/E of 49.28, while the average P/E ratio for the semiconductor industry is 34.74. The difference between the two indicates that investors have high expectations for the company's future earnings growth. Valuing and picking stocks is admittedly not our lane. Still, we see Nvidia's stock price as overvalued with a general tech and AI stock bubble. Further, there is a slew of startup competitors that will start grabbing the company's market share in 2025. AMD, Intel, and Google are also making significant strides to compete with Nvidia in the AI chip market.

The shift to 'edge computing' (i.e., localized processing) will also invariably reduce reliance on Nvidia's GPUs as companies like Apple and Qualcomm develop AI-optimized chips for devices. We have great respect for Jensen's perseverance and the gritty story behind Nvidia's entrepreneurial success. Although he didn't require an H1B Visa to come to America from Taiwan with his parents at age nine, Jensen is still indeed an example of why we need to keep our borders open to talented non-nationals pursuing education and long-term residency in the US. We also thank him for making us look smart for picking Nvidia's (NVDA) stock for our 2024 predictions and posting a whopping 191.7% return for the year. 😎🙏🏼 We predict it will be a different story in 2025. TechBro backlash intensifies in 2025TechBro leader Elon Musk is not a fan of billionaire hedge fund manager George Soros because he ‘hates humanity and wants to erode the very fabric of civilization.’ So now Elon has described himself as the ‘George Soros of the middle and counterweight to his liberal influence.’

First of all, as we venture into 2025, we are officially calling bullshit on the antiquated labels 'left,' 'right,' 'liberal,' 'conservative' and 'moderate.' What do those labels even mean anymore? Cryptonite's editorial policy is never to utter political labels, as their only purpose is to insult and manipulate. Elon's solution is to intimidate Democratic law makers who oppose his policy proposals by threatening to bankroll their 'moderate' political competitors, as he did during the recent budget scrap. Reminder: The Democrats lost because they have become the Party of the Elite. We agree with Elon's views on Soros and his wannabe and much less savvy and intelligent son, Andrew, but becoming a devil to combat the devil won't make you a saint. As it is, Trump is stuffing his administration with billionaires, and, as we have reported, every single Democratic Party-funding TechBro billionaire (i.e. every top BigTech exec) has popped up at the Mar-a-Lago Estate to wash the Boogeyman's feet out of pure, unadulterated self-interest. All of which will be exposed in 2025.

The new administration hasn't even begun, and they already have a 'concentration of wealth and influence vibe,' which is what put the Donkeys out of business. Our advice to the TechBros is to stick to your X posts and keep your money in your pockets, push to reform campaign finance laws to limit individual donations to $100 per candidate and kill PACs and corporate donations. But the TechBros won't do it, and they will be despised as arrogant and annoying by the end of 2025. Don't say we didn't tell you so.

OpenAI is another perceived technology Titan that will be diminished in 2025Our editors have never been a fan of OpenAI, mainly because its results often end with a little sermon we didn't ask for. Political correctness is out of fashion now, and they need to get with it. We predict the company will lose its perceived leadership position in GenAI due to the following challenges and controversies the company faces. Over-Stretched CEO—There are indeed concerns among industry and management experts that Sam Altman is spread too thin, including managing an investment portfolio of over 400 companies valued in the billions. His involvement in so many companies (many of which could be deemed as potential conflicts of interest) is unconventional for a Silicon Valley startup CEO. OpenAI is operating in the most fiercely competitive marketplace in the world and needs 110% of its CEO's attention.

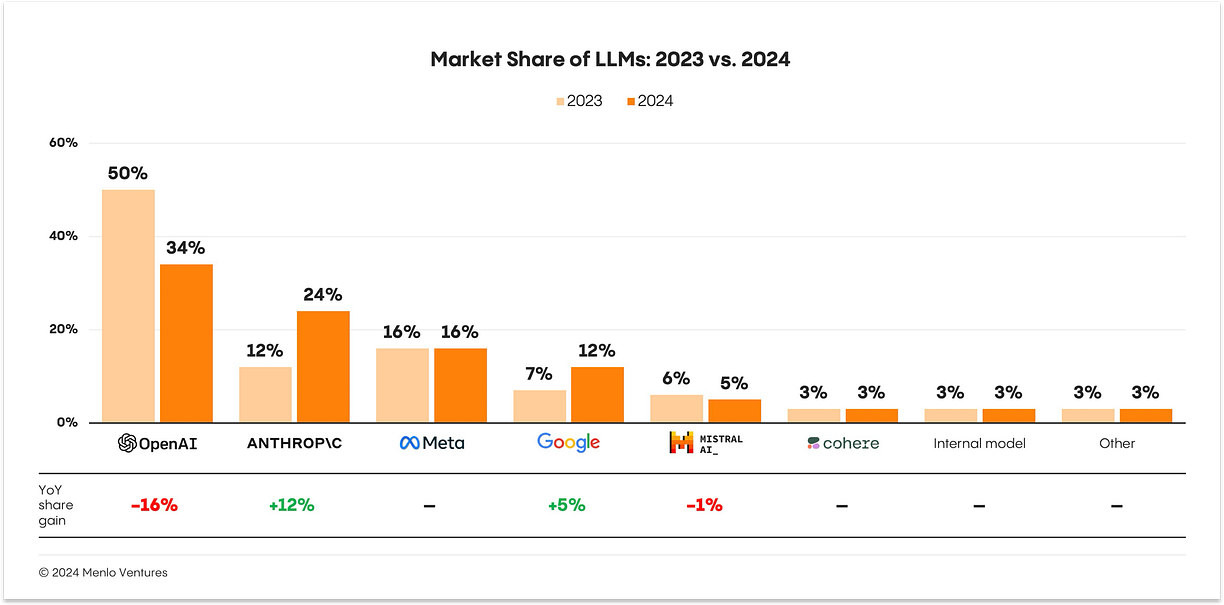

Competition with agile startups and BigTech—OpenAI faces increasing pressure from competitors, particularly from Elon’s xAI startup, Anthropic, and a rising Chinese startup called DeepSeek. A recent study by Menlo Ventures showed that OpenAI lost market share in enterprise AI this year, dropping from 50% to 30%, while competitor Anthropic doubled its share in the sector. Oh, and there are also the major players with unlimited financial resources, like Microsoft (ironically, an OpenAI investor), Google, and Amazon, who are jumping head-first into the AI game.

|