From: The Cryptonite Weekly Rap <cryptoniteventures@substack.com>

Date: Sat, Feb 1, 2025, 10:24 AM

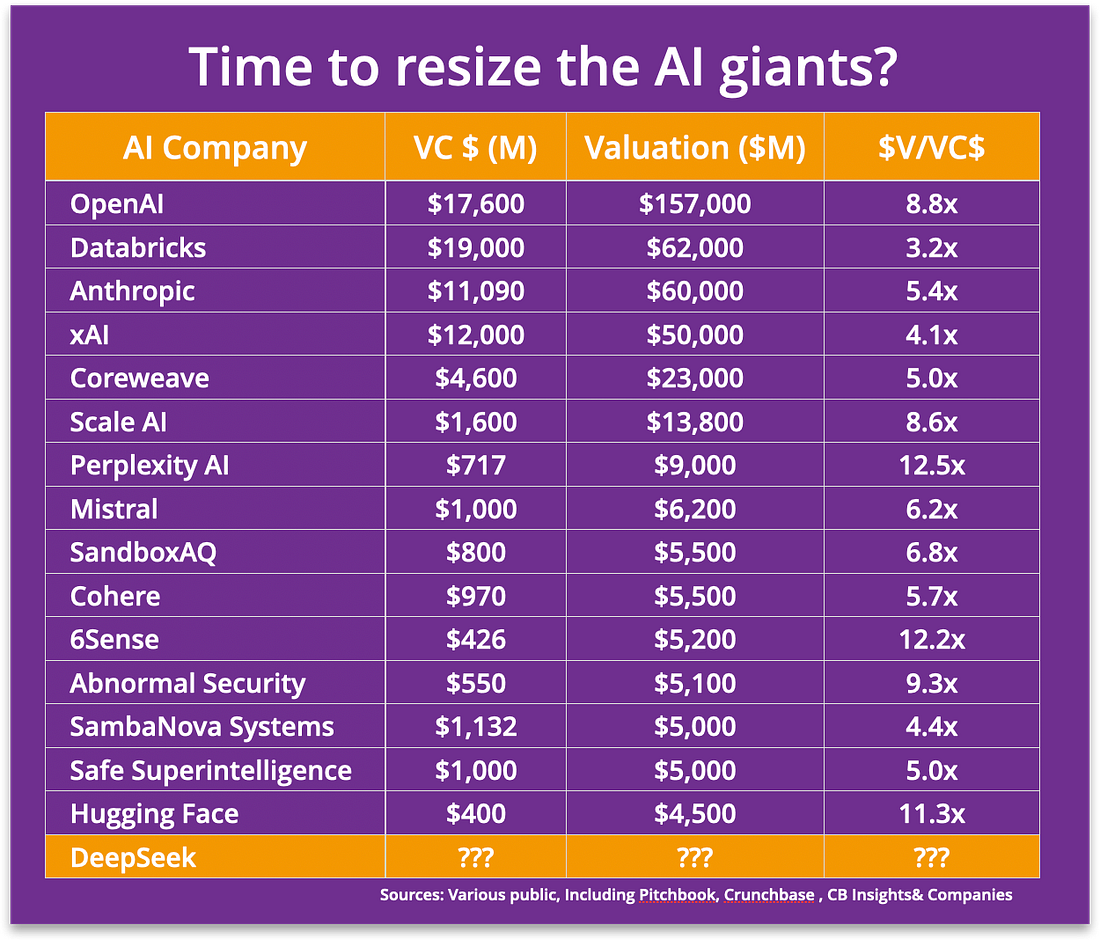

Subject: If DeepSeek wiped out $1 trillion of public tech company value—Just watch what happens to private AI company valua…

To: <g@xny.io>

Who will end up holding the bag of AI stocks when this market pops?During the Internet bubble era (1993-2023), we created $5 trillion of new wealth and then destroyed it. Driven by 200+ Internet companies that should never have gone public (or got funding at all), NASDAQ skyrocketed to 5,048 by March 10, 2000, blew up, and then punishingly twirled down over a two-and-a-half year period and bottom-out at 1,114 on October 9, 2002. Before the pop, the VCs who bet early on the Internet were able to push their portfolio companies' stock out into the public markets largely into the hands of overly whooped-up retail buyers. Between September 1999 and July 2000, VC firms like Kleiner Perkins and Sequoia Capital and their networks of angels cashed out approximately $43 billion to the public markets (when a $billion was BIG money💰!)—twice the return rates of the no so bad two previous years—and claimed big wins to their limited partner investors. In retrospect, the VCs won big, and the retail investors were caught holding the bag. Nvidia's half-a-trillion-dollar market cap drop last Monday and the other BigTech stock carnage was an early warning signal that tech companies, both public and private, are overvalued. Public and private stocks and cryptos markets have been over-inflated by the Trump Pump and AI hype. It all begs the question—Who is going to be holding the stock bubble bag this time around? The VCs or the overly enthusiastic retail investors.

One of the biggest differences between the Internet and AI stock bubbles at this moment in history is that 90%+ of the AI companies are still private. During the Web1 bubble, 217 'dot-com' companies had already gone public. If our overvaluation premise is true, then it will be interesting/entertaining to see how the VCs handle this predicament. In their ideal world, public tech investor jitters settle, and they start pumping their portfolio of AI companies out the public door like it was in 1999. Tip for VCs: When you are up early doing your calisthenics and pounding your blueberry + whey protein smoothies, blast this epic Prince tune, 1999, on your headset to keep psyched up. Even Christian McCaffrey would have a tough time trying to blow through the tiny window that sits in front of you.  “Cause they say 2000, zero-zero, party over, oops, out of time So tonight I'm gonna party like it's 1999!” —Prince from his hit 1999—God bless him—We appreciate the memories. The book my brother Michael and I wrote, called The Internet Bubble: Inside the Overvalued World of High-Tech Stocks,' was published by HarperBusiness on November 1, 1999, when NASDAQ was at 2,970. The tech-heavy NASDAQ kept rising to its height of 5,048 on March 10, 2000, so we didn't look so bright for the six months before the pop.😅😅 The interesting thing to note is of the over 50 top VCs (e.g., Don Valentine, Tom Perkins, and Bill Gurly) and Internet entrepreneurs (e.g., Jeff Bezos, Yahoo founder Jerry Yang, and Internet browser inventor Marc Andreessen), we interviewed for the book they ALL acknowledged that Internet stock prices were out of control and not sustainable. Almost none of the Internet stocks were making money, and a high percentage didn't even have revenues. But as one VC admitted at the time, ‘Are these valuations rational? Not at all. But we either sit on the sidelines and watch everyone else make money or jump in and make money too while the market is hot.’ A top technology investment banker shrugged at the time, saying it is their 'job to put the IPOs on the stoop and see if the dogs will eat it.’

The primary point of this post is to widely broadcast that since the DeepSeek story slapped Silicon Valley back to reality, we don't believe there is a single high-rolling, AI-betting VC on this planet that isn't pacing their luxury second home floors on Kona or in Montana somewhere feeling powerless. They have been boasting about the rise in valuation of their AI portfolio companies to their Limited Partners for the last two to three years now. The new reality is that AI VCs may have invested too much money at too high valuations, and their minds are spinning. The only option, before the rest of the world figures out what they now know, is to sell, baby, sell! The problem is that the public markets are too overvalued to open up the IPO doors just yet, and BigTech company buyers know what the VCs know, so they ain't going to buy any GenAI startup at the top.

DeepSeek and the Open Source AI modelDeepSeek, the Chinese AI startup that has been causing all the stock market commotion, was founded in May of 2023 by hedge fund manager Liang Wenfeng. Mr. Wenfeng is also the founder of High-Flyer, one of China's top quantitative hedge funds, with $8 billion under management. The company's recent announcement of its DeepSeek-R1 model has not only knocked a trillion of market cap out of tech stocks but has also put the company's brand on the cutting edge of AI research. DeepSeek is now a shining example of China's growing capabilities in AI and quantitative finance.

The DeepSeek-V3 base language model foundation uses a mixture-of-experts architecture to handle tasks more accurately and efficiently. The recently introduced DeepSeek-R1, built upon the DeepSeek-V3 foundation, is already matching or outperforming the power of closed model AI bots, including OpenAI's ChatGPT, Meta's Llama, and Anthropic's Claude. DeepSeek-R1 is also 10 to 50 times more affordable and cheaper to run, depending on the task. These power stats and the fact that DeepSeek's model efficiency means needing fewer AI chips are what sent Nvidia's stock tumbling. The final market shocker was DeepSeek's now debunked report of only spending a mere $5.6 million in model training costs versus an estimated '$100 million to $1 billion' for Anthropic's Claude, according to its CEO Dario Amodei, or Sam Altman's claim that it cost more than $100 million to build OpenAI's GPT-4 model. Driven by all this excitement, DeepSeek's app rose to No. 1 on the Apple App Store, and downloads soared, reaching 2.6 million across the App Store and Google Play as of last Monday morning.

Part of the chatter on the streets of Silicon Valley is that in the long run, the AI winners will not be the companies that produce what will become remarkably fast marginal cost commodity services. The winners will be AI-powered users leveraging the new tools to spend less time producing a lot more work. 🤔

In our view, the biggest significance of the DeepSeek splash is highlighting a trend that suggests open source AI communities will play an increasingly significant role as AI innovators, accelerators, and cost cutters, spurring open access to advanced AI capabilities for the betterment of all.

AI Bubble EpilogueThe bottom line is that the AI bot business will evolve into a highly valued, commodity-priced service delivered with significantly less development and operating costs compared to those paid by first-generation GenAI companies. Just as stocks can't escape P/E ratios, AI companies can't escape Moore's and Metcalfe's Laws. We lean with our boy Palmer Luckey, the founder of Anduril, about DeepSeek doing a DeepFake on its cheap training numbers. For one, the DeepSeek foundation reportedly used 2,048 H800 GPUs for its training, which alone costs between $50-100 million. At best, this ploy was part of a very successful marketing stunt worth a ton of app downloads, or at worse, part of a CCP plot to control more of our personal information. We sadly think it's both. No matter how deep the conspiracy goes, it can not be denied that the Chinese now have a highly competitive AI platform driven by open source development and a model that challenges the financial models of ALL the private AI companies listed in the table above, as well as Nvidia, Meta, and many other companies in the AI space.  Web1 |