From: The Cryptonite Weekly Rap <cryptoniteventures@substack.com>

Date: Tue, Apr 29, 2025, 2:43 PM

Subject: The top blockchain & crypto private companies for 2025— the New Oligarchs, Open letter to AI & Crypto Czar David S…

To: <g@xny.io>

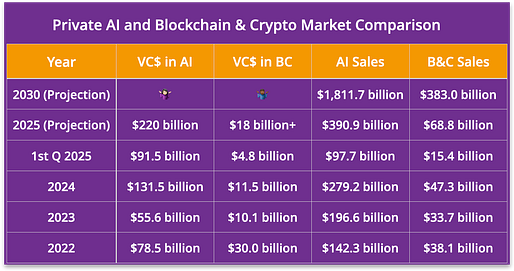

Achieving the Bitcoin metaphorThe principles and promises of the Bitcoin metaphor remain the same: financial sovereignty, peer-to-peer interaction, global accessibility, and resilience—that is, freedom from censorship, shutdowns, and single-point failures. Fairness and transparency are the common threads. When Perplexity AI's search and Chat GPT first hit the scene at the tail end of 2022, AI had finally touched the masses. One could tell immediately that those were historic events that foreshadowed how AI would transform the world and how we operate and live. Suddenly, the crypto and NFT crazes seemed like desperate stories of days gone by. We will stick out our necks and predict that the blockchain promise and the companies delivering on it will rise again in 2025 and through 2026. Part of the reason for this belief is that we see the AI movement as an offensive strategy to increase individual power and productivity. At the same time, blockchain is our defense against AI innovation spinning out of our control. We need both to move ahead safely. At first glance, the AI sales numbers appear to support the idea that the AI opportunity is 5 times larger than the blockchain one measured by total industry sales. At a closer look, one can see a different yet fascinating reality beneath these numbers. First, on average, it takes twice the VC money for AI companies to achieve the same revenue levels as blockchain companies. AI companies have to buy lots of AI chips and build expansive computational infrastructures, which come with massive capital requirements. We haven't done the numbers here, but it will be interesting to see how the VC AI investment multiples scale, especially in the later funding stages. AI could become a less exciting (or underwater) investment experience for late-stage VCs, especially with a stodgy IPO market. As we know, high-capital-intensive businesses traditionally show lower multiples. Second, when you analyze the companies in our top blockchain company list below, you will see many impressive examples of companies such as Ripple, Solana, Chainlink, Dapper, and Polygon Labs complementing their VC money by selling non-equity-based tokens and significantly preserving founder ownership.😎👍🏼 We see the VC model going back to the future. That is, the VC business will consolidate back to a small cadre of early-stage firms and startup industry networked and savvy partners who live on the streets of global Silicon Valley and source all the deals. Many entrepreneurs with solid tokenomics strategies will offer a hybrid of equity and utility tokens to preserve ownership. Other entrepreneurs will give up traditional early-stage prices with quality VCs but quickly offer higher-priced equity tokens to broader audiences (think talent-to-fan) with fewer rights as a tactic to retain more control and higher ownership stakes in their companies. The inevitable two questions every entrepreneur eventually asks: 'I understand the value I get out of Draper, Andreessen, and Sequoia, but what value do these 'later stage VCs' provide? Why do these money managers get VC pricing?' This approach could also prolong and even eliminate the need to go public. Speaking of street-savvy VCs, we would like to give a shout-out to the handful of firms that invested in extensive blockchain projects and helped pioneer the early Bitcoin, blockchain, and crypto revolution through some truly crazy times: Draper Associates, Boost VC, Andreessen Horowitz (a16z), Sequoia Capital, Pantera Capital, Coinbase Ventures, Binance Labs, Digital Currency Group (DCG), Paradigm, Polychain Capital, Blockchain Capital, and Multicoin Capital. 👏🏼👏🏼. There are other firms in this exclusive crypto club and a whole slew of amazing angels.😇 In the next issue of The Rap, we will uncover the risk investors behind the top blockchain companies.

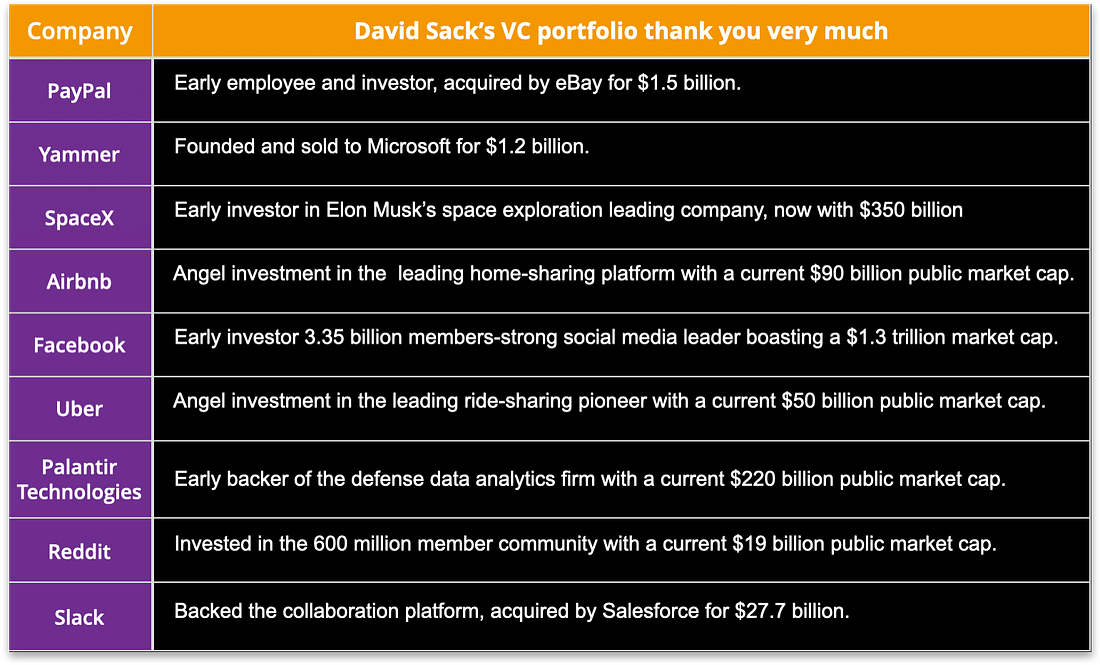

Putting US cryptos on the table for the security and sanity of us allIt would be hard to find a curriculum vitae touched more divinely than that of Bogeyman's AI & Crypto Czar, David Sacks. A South African who came to Silicon Valley via Stanford University, Mr. Sacks started his career as the COO of PayPal, founded by Peter Thiel and the Cowardly Lion, and one of only a handful of companies that survived Web1. He went onto to form Craft Ventures, which has to have one of the most pristine and successful early stage investment portfolio records on the planet. As a loyal immigrant who hugely benefited from the privilege of landing on our soil and pursuing the American Dream, Mr. Sacks has apparently cashed it all in to show appreciation for his adopted country. To join Trump 2.0 and help put in the work to keep the US on top of the crypto and AI industries, Mr. Sacks divested $200 million of personal assets, including $85 million in cryptos. We frankly have no idea how Mr. Sacks is doing in DC, a dark, creepy, lawyer-infested world that Silicon Valley entrepreneurs are violently allergic to. From what we can tell, Mr. Sacks is to help inform and guide AI and crypto policy, which is fair enough and a good thing because we trust him.

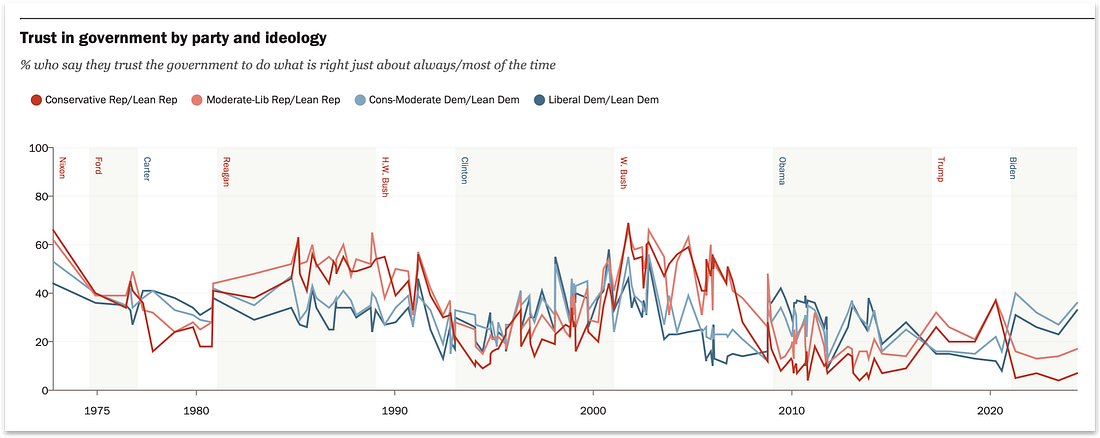

Rising above all the wonkism, we offer six big ideas to our man in DC that would display our Web3 dreams in full and living color. We are not naive and believe these initiatives are simply implemented. They are disruptive and intense and need to be demo'd and pitched to our fellow citizens. We need to show that the opportunity to take back the power from the institutions we no longer trust and will never trust again is at hand. And the innovation required to make this happen is already here and enshrined in Mr. Sack's new title.

We can fix the trust crisis, and we must fix it because it's our country. The days of waiting around for politicians to get their shit together are long gone. It's never a good idea to give a job to people you don't trust anyhow. Dear Mr. Sacks,Congratulations on your new appointment. It's time to deploy the power of AI-infused blockchain apps and mint cryptos to help restore our trust in government. A higher purpose here is to also rally everyone from the AOC and Bern Man groupies fighting Oligarchs to the red-hatted throngs who want to take down the Deep State. The desire on both 'sides' is the same—Take Back the Power. Everyone wants to bring down the Bigs, and we are all exhausted from corporate media and political party indoctrination and manipulation.

The following are the top six initiatives we propose to get started. They nicely cross-sect with the initial spirit of the Boogeyman administration's earnest efforts to downsize and decentralize government. They should also appeal to those interested in addressing the needs of the hungry and single mothers, democratizing 'elite' education, reducing education costs, and re-establishing our personal sovereignty and privacy. And to emphasize what we know you already know: All the technology solutions necessary to execute these initiatives exist today, so this is not a trip to Neverland. Reclaiming our identitiesThis initiative is just as much about restoring our mental health as it is about maintaining the long-term security and privacy of our citizens. The Trump administration has made initial efforts to tighten ID requirements to help prevent voter and social security fraud. As an example, DOGE has identified 20,789,524 US citizens shown in the SS as over 100 years old and receiving Social Security benefits, with 1,039 of those folks between the ages of 220 and 229.😳 A July 2023 SSA Office of the Inspector General (OIG) report also found improper SS payments from 2015 to 2022 totaled $71.8 billion.😳

Feeding the poor taxpayer-to-neighborWe previously shared the stat that the Mother Teresa-founded Missionaries of Charity can feed 20 people with $1, whereas USAID can only feed one. Assisting people directly and on a local level is the best way to deliver services, and it is the least expense. (i.e., no overhead). Today, we could set up a decentralized platform to achieve the same efficient model and spirit as the Missionaries of Charity. Here are the two basic bullet points:

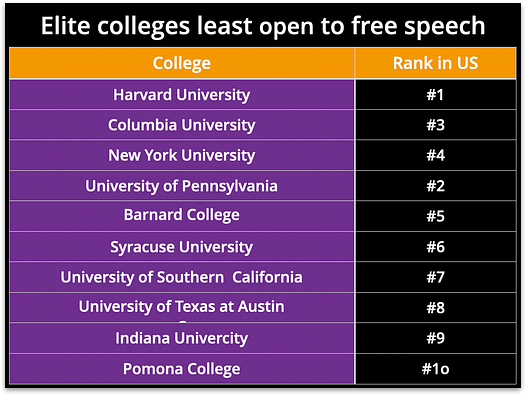

This model will inspire broader community awareness and foster a deeper connection with our neighbors and their needs. Putting our CVs on the blockchainWhen only 36 percent of people trust higher education, only 32% of four-year college graduates say college is worth the cost, and our 'most esteemed' educational institutions are no longer open to free speech, you know our current education system is f*ucked. (Pardon us, but...) Thankfully, the solution to gaining more access to the best experts and instructors, building and managing our own credentials and transcripts, and substantially reducing education costs is right in front of us. Here is how it works.

Ideally, gaining new knowledge is one of the most enjoyable, rewarding, and lifelong experiences. The ability to more easily access the best and the brightest, master a subject or skill, and add it to your immutable credentials that only you can share is a motivating and self-esteem-building setup. Significantly, a more comprehensive and validated background record also increases your perceived value in the marketplace. In turn, the best teachers would be free from institutional administration and restrictions, build their reputations, and have the potential to make millions of dollars by leveraging and sharing their knowledge and expertise with the world.

Outflank the CCP’s e-CN¥ with a digital USDThe US is not only behind in doing the work to set proper crypto policy, we are way behind the Chinese Communist Party (CCP) in piloting a digital USD. To summarize the potential value of a digital USD, all you have to do is read the analysis of the US-educated Governor of the |